Register O’Donnell Reports on 2022 Annual Real Estate Activity in Norfolk County

Dedham – Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for 2022 indicate a shifting real estate market, where the year started off strong and ended with significant drops in mortgage activity and average property sale price as compared to 2021.

In 2022, there were 130,051 documents recorded at the Norfolk County Registry of Deeds, a 33% decrease from 2021.

"The real estate market is feeling the effects of inflation and steadily rising interest rates, which is limiting how much money customers can save," said Register O’Donnell. "The total number of documents is much lower in 2022 than it was in 2021, but the change from month to month is less pronounced. The number of recorded deeds, which is one measure of document volume, shows a drop in real estate sales from the previous year."

The number of deeds for 2022, which reflect real estate sales and transfers, both commercial and residential, was 17,398—a decrease of 17% from 2021.

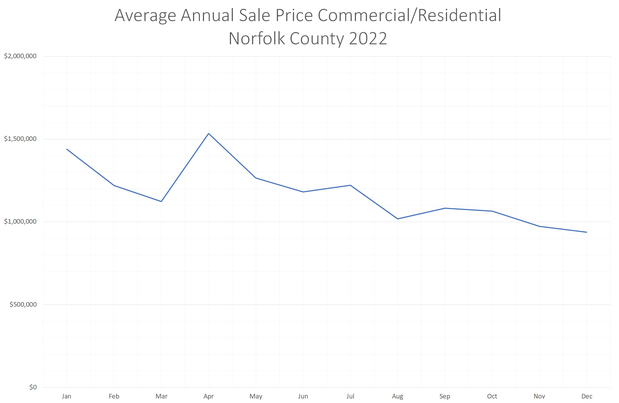

Sale prices for 2022 appear to have increased slightly compared to 2021. The average sale price for all of Norfolk County, both commercial and residential, this year was $1,173,256, a 10% increase from 2021. However, the total dollar volume of commercial and residential sales is down, decreasing 10% from one year ago.

"With the average sales price showing increases for the year as a whole and the total volume of sales decreasing, indicates that in 2022 there were fewer homes being sold, but at a higher price," said Register O'Donnell.

According to numbers from the Consumer Financial Protection Bureau, the median interest rate of a 30-year fixed-rate conventional loan started at 4.14% in January 2022 and grew to 6.61% by December 2022, a more than 63% increase.

"The increasing cost of living and rising interest rates that the country is currently experiencing have an effect on the local real estate market," noted O’Donnell. "With interest rates more than double what there were at the start of 2022, consumers appear to be less inclined to borrow, and the decline in average sales prices suggests sellers are lowering pricing to compensate,"

Overall lending activity showed a continued downward trend. A total of 23,265 mortgages were recorded at the Registry in 2022, 50% fewer than a year earlier.

"This year, month to month, the registry figures show significant increases in the number of pending foreclosures, with as many as 40 in one month," said O’Donnell.

The Norfolk County Registry of Deeds has been closely monitoring the foreclosure market. In 2022, there were 68 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in 2021 there were 52 recorded. However, in 2022, there were 308 notices to foreclose, the first step in the foreclosure process, significantly more than the 141 recorded in December of 2021.

"The substantial increase in the number of notices to foreclose is troubling. This suggests that more of our neighbors may have financial difficulties in the future," said O'Donnell. "We have seen this number more than double this year and will continue to monitor these figures in 2023."

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

"If you are having difficulty paying your monthly mortgage, please consider contacting one of these non-profit agencies for help and guidance," said Register O’Donnell.

Register O’Donnell concluded, "Inflation in the US has been increasing since mid-2021, and it hit a 40-year high exceeding 8% in September 2022. The Federal Reserve raised interest rates many times in 2022 in an effort to slow the rise in inflation. As a result, borrowing money now costs more. This year, mortgage rates have doubled, which has led some buyers to pause their home searches, and, on average, fewer offers are being made to sellers."